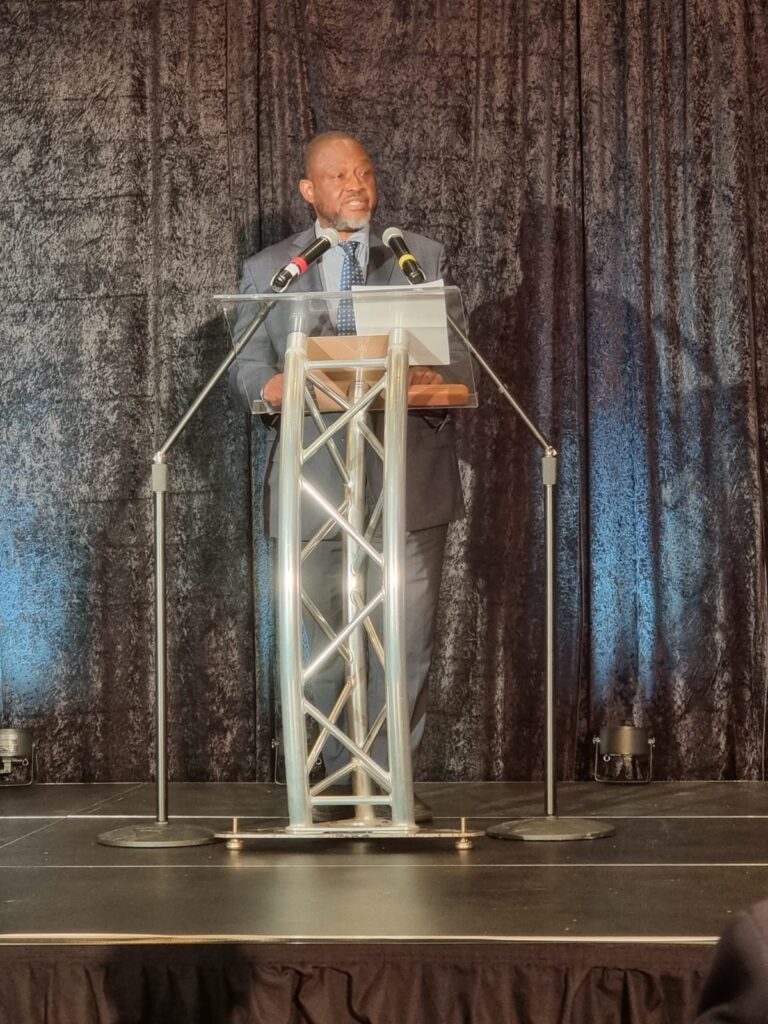

AFRAA Secretary General – Mr. Abdérahmane Berthé, addressed the 52nd AGM of the Association of Airlines of Southern Africa (AASA) on 14 October 2022, Cape Town – South Africa.

- STATE OF THE INDUSTRY

The airline industry is on a recovery trajectory from the impacts of the Covid-19 pandemic. As at September 2022, AFRAA data reveals that traffic and airlines capacity deployed reached 82.52% and 82.1% of the 2019 level respectively. African airlines have now resumed operations to 99.2% of routes operated before the pandemic. Eight African airlines have exceeded the number of international routes they operated before Covid.

Before the Covid19, African traffic represented about 2.5% of world traffic. In 2021, Africa’s contribution to global traffic dropped to 1.8%.

African Aviation is recovering from the Covid19 even if we are not still at the level of activities in 2019.

FUEL

The Russia-Ukraine crisis has brought up a new challenge impacting the pace of our industry’s recovery. The steep rise of fuel prices from 78$ a barrel in 2021 to an estimated average of 142$ in 2022 is deteriorating airlines’ financial performance.

BLOCKED FUNDS

Another challenge is the issue of blocked funds in many countries due to the combination of a strong USD and the inflation of imported commodities prices. We call upon African governments to consider Aviation as a priority sector and reduce the level of blocked funds.

REVENUE LOSSES

African Airlines passenger traffic dropped 60.2% in 2020 due to the Covid19. By 2022, the activity is recovering and shows an improvement of the load factors. However, we are not yet at the levels of 2019.

The Passenger Revenue Losses for 2021 were USD 8.6 billion, representing 49.8% of 2019 revenues. We estimate the same at USD 3.5 billion for 2022 representing 20% of the 2019 full year revenues.

CONNECTIVITY

The percentage of international routes operated by African airlines compared to Feb 2020 reached 99.2% in September 2022.

However, connectivity is still low in Africa. Currently, up to 22% of Africans traveling between two African cities are forced to travel through non-Africa HUBs either in Europe or the Middle East. This situation can be reversed only through Networks and Schedules Coordination at African hubs.

Connectivity is intricately aligned to trade, business development, and tourism. Currently, the Intra-Africa trade is modest at 18%, which is very low compared to Europe (64%) or Asia, which is above 50%.

Indeed, there are no significant Intra-Africa tourism flows.

If there is no Intra-African trade, business, and tourism development, any traffic growth will strengthen the existing routes and will not serve the intra-Africa connectivity.

GDP PER CAPITA

Before the Covid19, the average GDP per capita in Europe was Eur30,000. Twenty-five (25) African countries had per capita income of less than $1,000, while only eight (8) had per capita income of more than $5,000.

A strong and consistent middle-class citizenry in the African continent is needed to boost the Intra-Africa traffic.

AFRICAN AIRLINES

Some constraints impact African Airlines’ growth prospects.

- African airlines operate with an average lower load factor than the world average.

- African operators’ average cost of the available seat-kilometer (CASK) is very high compared to other regions.

- Competing for market shares, African airlines charge less US Cents per Passenger-Kilometer-Carried than other regions’ air carriers on equivalent travel distances.

- Despite this, the average fare of passenger tickets in Africa, including taxes, is higher on equivalent travel distances.

- Consequently, with high fares and lower GDP per capita, air transport is not affordable for African citizens.

In 40 years, the continuous reduction of African airlines’ intercontinental market shares set the trend of marginalization of African Aviation on the international scene.

From 3.5% in the early 1980s to 2.5% in 2019, Africa’s contribution to global traffic is currently at around 1.8%.

From 45% in the nineties, African Operators’ market share of traffic to/from Africa dropped to 20% pre-Covid in 2019, of which the Top 3 African Airlines accounted for more than 50%.

2. OUTPACING GLOBAL GROWTH AS AFRICAN AIRLINES EVOLVE

So, how do we get to better skies for African Operators?

The current air transport status and trends require a massive transformation of the industry to:

- Push the boundaries by thinking out of the box.

- Perform beyond the status quo.

The recovery and traffic growth projected for the future can be realized if the regulatory environment is conducive and Air Operators become more sustainable.

AUC 2063 AGENDA FLAGSHIP PROJECTS:

Market access is a critical challenge for African Airlines. The Single African Air Transport Market (SAATM), launched by the African Union Commission (AUC), will positively impact air transport in Africa, increasing connectivity and reducing journey time and airfares.

Complementing SAATM, the other AU Agenda 2063 flagship projects that envision an integrated Africa with seamless borders include the African Continental Free Trade Agreement (AfCFTA) and the Free Movement Protocol for people and goods.

As the African Continental Free Trade Area unfolds and increases Intra- African trade, new routes will emerge to serve the resultant demand, and connectivity will improve.

AFRICAN AIRLINES SUSTAINABILITY

At AFRAA, our vision is “a sustainable, interconnected and affordable Air Transport industry in Africa where African Airlines become key players and drivers to African economic development.”

We believe stakeholders’ engagement and commitment are vital drivers to transforming the industry.

The first Laboratory on Air Transport Sustainability in Africa was held from 27 June to 01 July 2022 at the AFRAA headquarters in Nairobi, Kenya. The LAB was necessitated by the urgent need to stop the marginalization of African airlines, restore industry competitiveness, re-gain and retain Intra-Africa traffic and grow Africa’s global market share

The one-week event brought together air transport, trade, and tourism stakeholders from across Africa to develop a roadmap for the sustainability of the African air transport industry.

At the end of 5 days of stocktaking, critical analysis, prognosis, and consensus building, the LAB developed a roadmap with specific actions assigned to stakeholder organizations, with defined timelines for execution. The roadmaps also contained implementation monitoring mechanisms and expected benefits upon complete execution.

A Steering Committee co-chaired by AFRAA and AFCAC, made up of all relevant stakeholder organizations in aviation, trade, tourism, and DFIs, will oversee the implementation of the roadmap. AFRAA remains dedicated to steering the roadmap, which will change the narrative of African aviation.

I take this opportunity to invite industry stakeholders to the 54th AFRAA Annual General Assembly & Summit scheduled to take place from 11-13 December 2022 in the country of Teranga – Senegal on the theme “Acing the Roadmap to Sustainable African Aviation”. Deliberations at the AGA will better prepare us to continue to rebuild Africa’s aviation to make the travel ecosystem more resilient and viable.

- CONCLUSION

A successful and viable African aviation industry requires concerted efforts and close collaboration among all stakeholders, from governments, regulatory authorities, airlines, airports, air navigation service providers, suppliers of a wide range of aviation products and services, and customers.

As I conclude, I wish to reiterate my thanks to the Association of Airlines of Southern Africa for inviting me to this Assembly being held under the theme: “My African Dream”. I look forward to deliberations and interactions during this Assembly that will reset, refocus, and reimagine our industry.

Thank you for your kind attention.